Have you ever wondered why $50,000 feels like a fortune in one country but barely covers rent in another? That’s purchasing power parity at work. Let’s understand what is purchasing power parity?

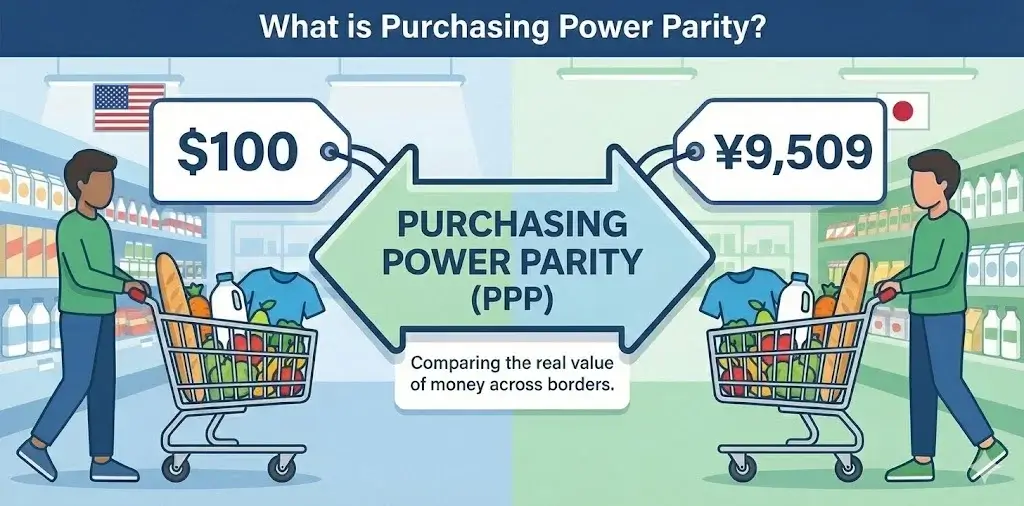

Purchasing power parity (PPP) shows you what your money can actually buy in different countries. It’s more accurate than currency conversion because it compares the real cost of living, not just exchange rates.

In this guide, you’ll learn exactly what PPP is, why it matters for your financial decisions, and how to use it when comparing salaries or planning international moves.

Key Takeaways

- PPP shows real value: Purchasing power parity reveals what your money can actually buy in different countries, not just currency conversion rates

- More accurate than exchange rates: A $50,000 salary has vastly different buying power in San Francisco versus Bangkok, which exchange rates don’t show

- Essential for job decisions: Use PPP when comparing international job offers, negotiating remote work salaries, or planning relocations

- The Big Mac Index makes it simple: This famous example compares burger prices worldwide to demonstrate PPP in action

- Based on official data: World Bank collects prices for hundreds of items across countries to calculate accurate PPP conversion factors

What is Purchasing Power Parity?

Purchasing power parity is a way to compare the value of money between countries. It measures how much a basket of goods costs in different places.

Think of it like this: Your $100 might buy 10 items in the US, but those same 10 items could cost only $40 in India or $150 in Switzerland. PPP shows these real differences.

The World Bank defines PPP as “the rate at which the currency of one country would have to be converted into that of another to buy the same amount of goods and services.” That sounds complicated, but it’s actually simple.

A Real-World Example

Sarah is a software developer looking at two job offers:

- Job A: $80,000 per year in San Francisco

- Job B: $50,000 per year in Lisbon, Portugal

At first glance, Job A seems better. But here’s what PPP reveals:

Using our PPP calculator, Sarah discovers that $50,000 in Lisbon has the same purchasing power as $87,000 in San Francisco. Suddenly, Job B is actually the better deal.

The currency converter only told her that €46,000 equals $50,000. PPP told her what really matters: what that money buys.

The Big Mac Index: PPP Made Simple

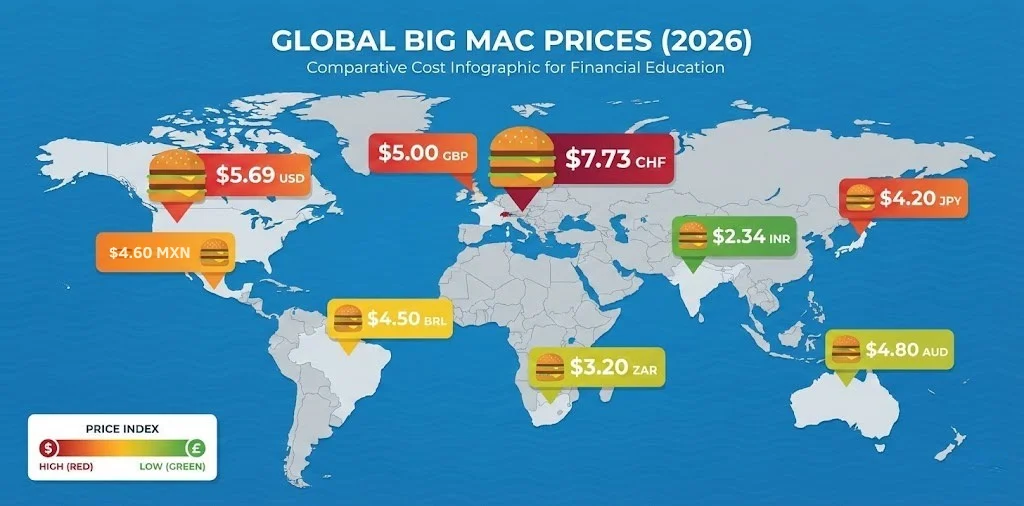

The easiest way to understand PPP is through the Big Mac Index, created by The Economist in 1986.

A Big Mac costs about $5.69 in the United States. But in India, it costs around 190 rupees (about $2.30). In Switzerland, it costs 6.50 Swiss francs (about $7.30).

The burger is essentially the same everywhere. So why the price difference?

This difference shows purchasing power parity in action. The Big Mac Index compares these prices to see if currencies are overvalued or undervalued.

What the Big Mac Index Reveals

When a Big Mac costs less in a country, it usually means:

- Lower labor costs

- Cheaper rent and utilities

- Less expensive ingredients

- Lower overall cost of living

This isn’t just about burgers. It applies to everything: rent, groceries, healthcare, entertainment, and transportation.

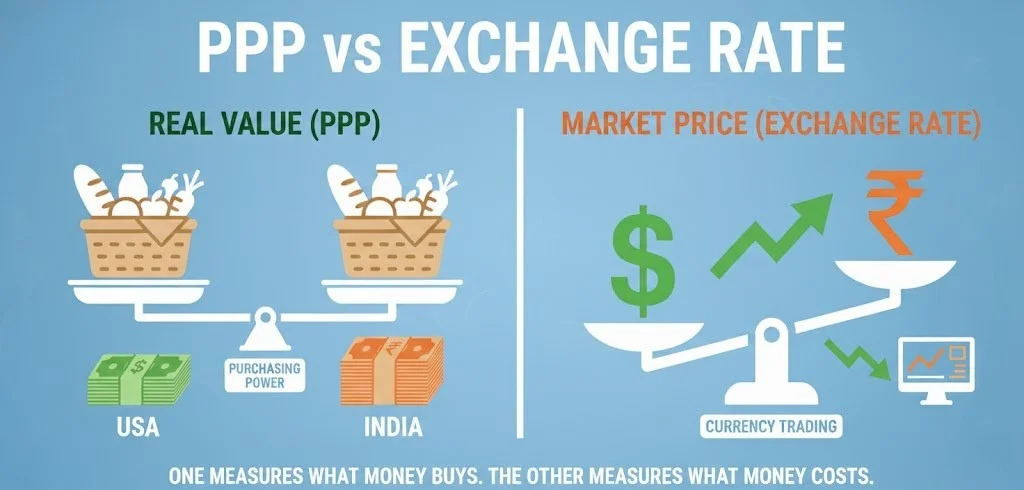

Why PPP Matters More Than Exchange Rates

Exchange rates tell you how to swap currencies. PPP tells you what those currencies can buy. There’s a huge difference.

Exchange Rate Example

The exchange rate says 1 US dollar equals 83 Indian rupees. Simple math, right?

So if you earn $60,000 in the US and move to India earning the equivalent in rupees, you’d get 4,980,000 rupees. The exchange rate makes this seem like a straightforward conversion.

PPP Reality

But PPP shows that $60,000 in the US has the purchasing power of about $180,000 in India. Your money goes three times further.

That’s because rent, food, transportation, and services cost significantly less in India. The exchange rate doesn’t capture this.

How PPP is Calculated?

The World Bank collects price data for hundreds of items across countries. These items form a “basket of goods” that includes:

- Food and beverages: Bread, milk, rice, vegetables, meat

- Housing: Rent, utilities, maintenance

- Transportation: Fuel, public transit, vehicle costs

- Healthcare: Doctor visits, medications, procedures

- Education: School fees, books, supplies

- Clothing: Basic clothing items

- Recreation: Entertainment, dining out, hobbies

Researchers compare how much this identical basket costs in each country. If it costs $1,000 in Country A and $500 in Country B, then Country B has twice the purchasing power.

The World Bank publishes official PPP conversion factors annually through their International Comparison Program. These factors are what power tools like our PPP calculator.

Common Misconceptions About PPP

1. “PPP and Exchange Rates Should Be the Same”

They’re measuring different things. Exchange rates reflect currency trading markets. PPP reflects actual living costs.

Exchange rates change daily based on trade, interest rates, and speculation. PPP changes slowly based on price levels and inflation.

2. “If PPP Says My Money Goes Further, Everything is Cheaper”

Not exactly. Some things might cost more. Electronics often cost the same or more in developing countries. International brands like Apple or Nike have similar prices worldwide.

PPP mainly reflects local goods and services: housing, food, transportation, healthcare, and domestic services.

3. “PPP Means the Country is Better for Living”

PPP only measures purchasing power. It doesn’t measure quality of life, healthcare quality, safety, climate, culture, or career opportunities.

A country where your money goes far might lack other things you value. Consider PPP as one factor, not the only factor.

When to Use PPP?

PPP is incredibly useful for specific situations:

Comparing Job Offers in Different Countries: You’re deciding between offers in New York and Berlin. PPP shows which salary actually gives you more buying power.

Negotiating Remote Work Salaries: Your company wants to adjust your pay based on your location. PPP helps you argue for fair compensation that maintains your purchasing power.

Planning International Moves: You’re considering moving to Bangkok, Lisbon, or Mexico City. PPP shows how far your savings and income will stretch in each place.

Setting Freelance Rates by Client Location: You’re a freelancer with clients in multiple countries. PPP helps you set fair rates that reflect local purchasing power.

Budgeting for Extended Travel: You want to travel for 6 months. PPP helps you estimate costs and choose affordable destinations.

Limitations of PPP

PPP isn’t perfect. Here are its main limitations:

- Quality Differences: PPP assumes goods are identical across countries. But a “standard apartment” in Mumbai differs from one in Manhattan.

- Spending Patterns: PPP uses average baskets of goods. Your personal spending might differ significantly.

- Non-Tradable Services: PPP works best for local goods and services. It’s less accurate for imported goods or internationally priced items.

- Regional Variations: PPP typically measures country-level differences. But costs vary hugely within countries. Living in Mumbai versus a small Indian town shows vast differences.

- Short-Term Accuracy: PPP data updates annually. Rapid inflation or currency changes can make PPP temporarily less accurate.

PPP vs Other Comparison Methods

PPP vs Cost of Living Index

Cost of living indexes (like Numbeo or Expatistan) show relative costs compared to a base city, usually New York. These indexes use PPP principles but update more frequently with user-submitted data.

PPP gives you official World Bank data. Cost of living indexes give you current, crowdsourced estimates.

PPP vs Salary Calculators

Many salary calculators simply adjust for tax differences and exchange rates. PPP-based calculators also adjust for purchasing power.

Always check if a salary calculator uses PPP conversion factors or just exchange rates.

PPP vs GDP per Capita

GDP per capita shows average economic output per person. PPP-adjusted GDP per capita shows the value of that output in purchasing power terms.

According to World Bank data, India’s GDP per capita is about $2,400 using exchange rates. But using PPP, it’s about $8,400 – reflecting what that money actually buys domestically.

How to Use PPP for Better Financial Decisions

Step 1 Identify Your Current Purchasing Power – Use our PPP calculator to establish your baseline. Enter your current salary and location.

Step 2: Compare Target Locations – Calculate what your salary would need to be in potential new locations to maintain the same purchasing power.

Step 3: Adjust for Personal Factors – Consider your actual spending patterns. If you eat mostly imported food or travel frequently internationally, PPP benefits decrease.

Step 4: Factor in Non-Financial Elements – Remember that money isn’t everything. Healthcare quality, career growth, family proximity, climate, and lifestyle matter too.

Step 5: Verify with Local Research – Cross-reference PPP calculations with real rental prices, food costs, and other expenses in your target location.

Real Success Stories Using PPP

Marcus: Software Engineer

Marcus earned $120,000 in Seattle. His company offered him the same role remote from anywhere. Using PPP calculations, he moved to Mexico City.

His equivalent purchasing power: $240,000. He kept his US salary while halving his cost of living. After two years, he’d saved an extra $100,000.

Priya: Marketing Manager

Priya received two offers: $75,000 in London or $55,000 in Berlin. The London offer seemed better.

PPP analysis showed the Berlin salary had equivalent purchasing power of $81,000 in London. She took the Berlin role and lives more comfortably.

Chen: Freelance Designer

Chen used PPP to set different rates for clients in different markets. She charges US clients $100/hour but Chinese clients $45/hour (equivalent purchasing power).

This strategy tripled her Chinese client base while maintaining fair compensation.

Frequently Asked Questions

Ans: No. PPP compares pre-tax purchasing power. You need to calculate taxes separately for each country. Some countries with lower PPP also have higher tax rates, affecting your final take-home pay.

Ans: The World Bank updates official PPP conversion factors annually. However, major updates to the methodology happen every few years through the International Comparison Program.

Ans: Yes, but with limitations. PPP is most accurate for people living like locals. Tourist prices often don’t reflect local PPP. A hotel in Thailand might cost the same as one in the US, even though local housing is much cheaper.

Ans: PPP uses average baskets of goods. Your personal spending pattern might differ significantly. If you buy mostly imported goods, eat at international restaurants, or have expensive hobbies, PPP benefits decrease.

Ans: Not necessarily. Countries where your money goes further might have lower wages, fewer career opportunities, or different quality of life factors. PPP is one tool for decision-making, not the only consideration.

Take Action: Use PPP Calculator

Now that you understand purchasing power parity, put it to work for your financial decisions.

Our free PPP calculator uses official World Bank data to compare salaries and purchasing power across 180+ countries. Get accurate results in seconds.

Whether you’re evaluating a job offer, planning a move, or negotiating remote work compensation, PPP gives you the real numbers you need.

Ready to see what your salary is really worth? Try free PPP calculator now and make smarter financial decisions.